Resources | Hardship Guide

Hardship Guide

This guide has been created to clarify CDFs hardship policy and the process of applying for early withdrawal of funds due to hardship.

Step 1: Determining Eligibility

Where an individual is temporarily unable to meet financial commitments due to unforeseen circumstances, it may be necessary to allow investors within CDF Community Fund to access their funds where there is an ‘exceptional circumstance’ that will or could lead to financial hardship.

Important Information

- Early redemption due to hardship is applicable to individual account holders only. Accounts held by non-individuals (such as companies, trusts or self-managed superannuation funds) cannot be accessed on hardship grounds

- For holders of a Mission Saver Plus account, 31-days notice of withdrawal is not required, please submit a withdrawal request via CDF Online

Click to view a table with examples of ‘exceptional circumstances and documents' which may support a request to withdraw funds. You can view our full policy

here.

Step 2: Submit your hardship request and supporting documentation

CDF requires all requests for early redemption to be received in writing. Submit your request by completing the Early Withdrawal Request Form and email a signed copy, along with supporting documentation, to csg@melbcdf.org.au.

Completing the form:

You’ll be asked to complete the following information:

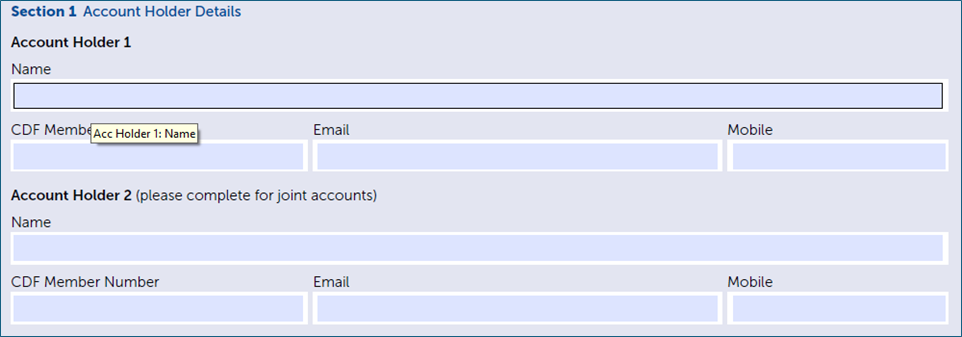

Section 1 Account Holder Details – name of account holder/s, CDF member number/s and contact details

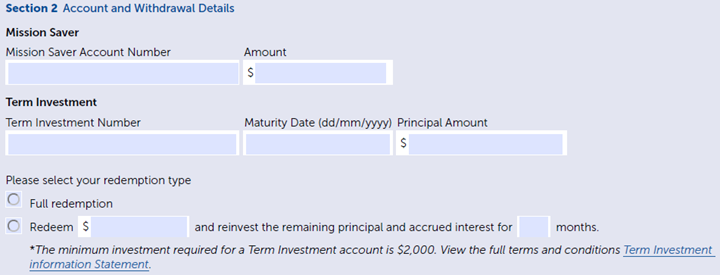

Section 2 Account and Withdrawal Details

Mission saver account number and amount or term investment number, maturity date and principal amount, full or partial redemption, and reinvestment details (for partial redemptions)

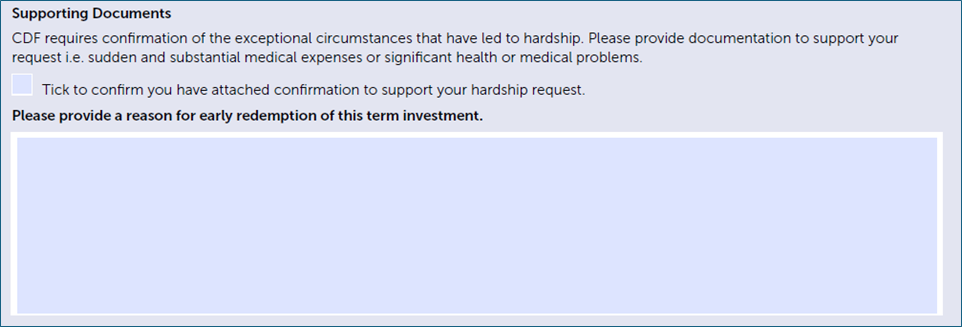

Supporting Documents and Reason for Withdrawal- confirm you have attached supporting documents, and provide a detailed explanation of the reason for early redemption

Supporting Documentation:

Some documents will require certification before we can accept them:

- Death Certificate

- Court Orders

Certified documentation: A certified copy means a document that has been certified as a true copy of an original document by one of the following persons:

- A person who is enrolled on the roll of the Supreme Court of a State or Territory, or the High Court of Australia as a legal practitioner (however described)

- A Justice of the Peace

- A notary public (for the purposes of the Statutory Declaration Regulations 1993)

- A Police officer

- An agent or permanent employee of the Australian Postal Corporation who oversees supplying postal services to the public

- An Australian consular officer or an Australian diplomatic officer (within the meaning of the Consular Fees Act 1955)

- An officer with, or authorised representative of, a holder of an Australian financial services licence, having 2 or more continuous years of service with one or more licensees

- A member of the Institute of Chartered Accountants in Australia, CPA Australia or the Institute of Public Accountants with 2 or more years of continuous membership.

- A foreign public notary whose appointment is lawful and their status as a notary public can be verified

Important information

- When crediting an external account, CDF requires confirmation of the account details before we can process your credit. If details of the account have not previously been provided to CDF, enclose a bank statement header which confirms the account name, BSB/Account Number and the name of the Australian Deposit-Taking Institution (ADI) with your request. This account must be in the name of the Term Investment account holder (excluding direct payment to funeral providers)

- CDF will credit funds to your nominated external bank account by electronic funds transfer (EFT). EFTs usually take 1-2 business days to clear, though payments eligible for The New Payments Platform (NPP) or Osko payments, can process within seconds, while standard transfers may take a day or two

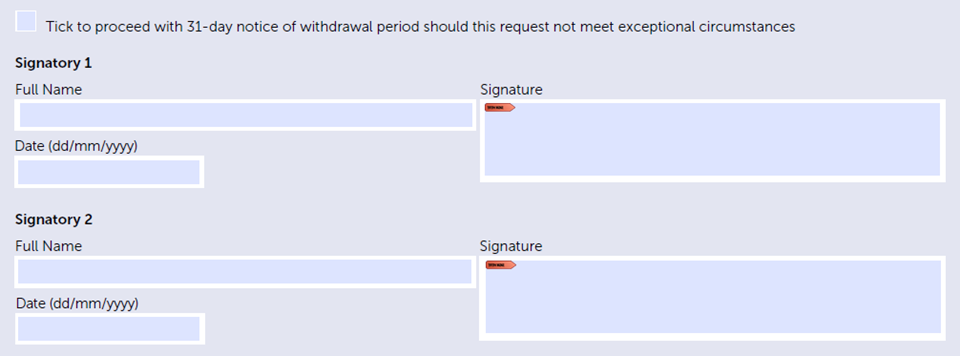

Section 3 Account Holder Authority and 31-Day Notice of Withdrawal

Important information

- Term Investments: If you need to withdraw your funds prior to maturity and do not meet the conditions of financial hardship, a 31-day notice of withdrawal period will apply. This means your withdrawal request will be processed no earlier than the 32nd calendar day from the day we receive your signed redemption request form. If you withdraw early, your entire investment will earn interest at the 31 Day Mission Saver rate that was in effect on the date you opened your Term Investment, instead of your original Term Investment rate. This lower rate applies to the entire balance over the period in which your money was invested, from opening date until withdrawal. No additional fees will be charged for early withdrawals.

Step 3: Assessment of your request

Once received, our team will review and assess your request. If the team requires further information to make an assessment, they will contact you directly to obtain this information.

Assessments can only be completed when all required information is received by CDF – please allow 2 business days for our team to review and assess your request.

Step 4: We’ll communicate the outcome of your request

Once your application has been assessed, you will receive a phone call, followed by an email to advise you of the outcome of your request. For clients who don’t have an email address, CDF will notify you by letter to the postal address on file.

Approved requests

- Approved requests will be processed within 1 business day of approval

- Term Investments: CDF will close your Term Investment and will process a credit to your nominated account

- Term Investments: For partial redemptions, we will establish a new Term Investment using the remaining principal and accrued interest for the term nominated on the form. Interest will be applied at the current advertised rate for the term selected – you can view our interest rates here

- Our team will email you to confirm your early withdrawal has been processed and, for partial redemptions, provide the details of your new Term Investment

Requests which are not considered to meet “exceptional circumstances”

- CDF will detail the reason your request does not meet “exceptional circumstances”

- If you have opted to proceed with a 31-day notice of withdrawal, our team will email you to confirm your instructions have been loaded

- On the 32nd day, or, when this falls on a weekend or public holiday, the next business day:

- Term Investments: CDF will close your Term Investment and will process a credit to your nominated account

- Term Investments: For partial redemptions, we will establish a new Term Investment using the remaining principal and accrued interest for the term nominated on the form. Interest will be applied at the current advertised rate for the term selected – you can view our interest rates here

- Our team will email you to confirm your early withdrawal has been processed and, for partial redemptions, provide the details of your new Term Investment